When comparing insurance providers for SR22 insurance in Tennessee, how do you determine which one is the best fit for your needs?

When comparing insurance providers for

SR22 insurance in Tennessee, how do you determine which one is the best fit for your needs? You'll want to take into account the provider benefits and coverage options that each insurer offers - Tennessee SR22 Insurance. Provider benefits can include things like 24/7 customer support and online policy management, while coverage options can vary regarding deductibles, limits, and exclusio

You're checking SR22 requirements, you're exploring tax implications, you're finding that SR22 insurance isn't typically tax deductible, impacting your overall costs and financial planning directly. (%anchor_text

You're exploring SR22 alternatives, and you can get SR22 insurance without a car by meeting SR22 requirements through non-owner policies, which cover you when driving vehicles you don't own. Economical

SR22 insurance TN coverage Tennesse

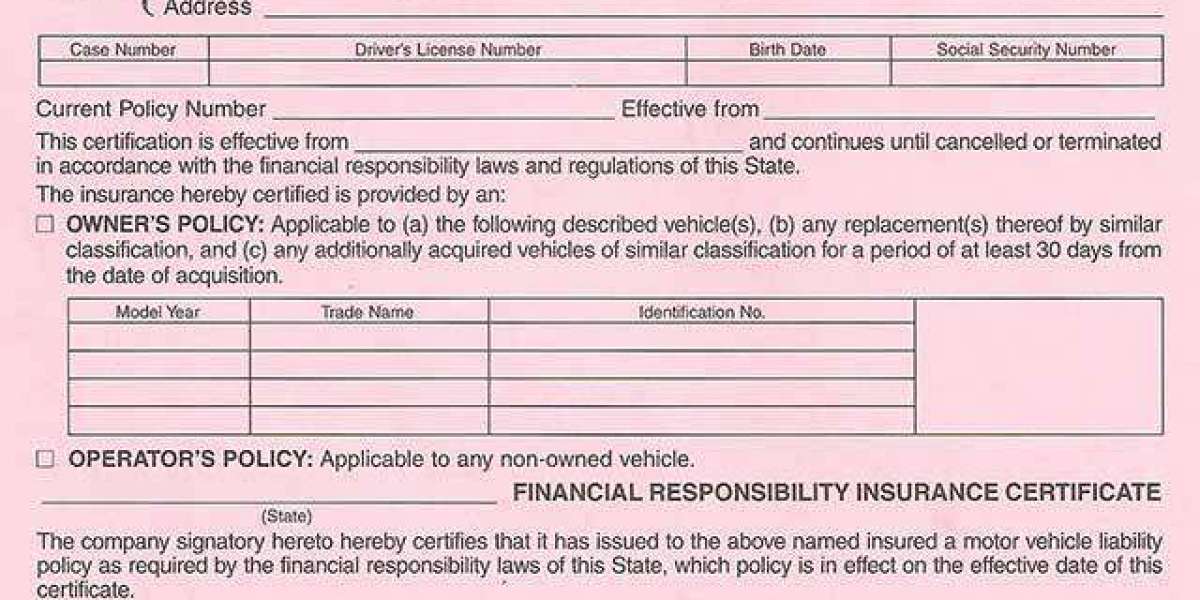

You're required to file an SR22 form with the Tennessee Department of Safety if you've had your license suspended or revoked due to certain traffic violations - personal automobile liability insurance policy. This form serves as proof that you have the minimum liability insurance required by the state. When you file for SR22, you're fundamentally certifying that you have the necessary insurance coverage to operate a vehicle safe

The Tennessee Department of Motor Vehicles mandates specific license rules for drivers required to file an SR22 form. You'll need to comply with these rules to avoid any issues with your driving privileges. If you're found guilty of a serious traffic violation, you may face a license suspension, which can be reinstated once you've filed the SR22 form and met the necessary requirement

Policy type: Different sr22 policy types, such as owner or non-owner policies, can affect the cost of your insurance.

Driving history: Your driving record will impact the cost of your SR22 insurance, with more severe infractions resulting in higher premiums.

Insurance provider: Shopping around for SR22 insurance quotes from different providers can help you find the most affordable optio

You can't cancel SR22 insurance at any time, you'll need to fulfill your insurance policy terms, as SR22 cancellation requires specific conditions to be met before termination. - Economical SR22 coverage Tenness

Deductible amounts: higher deductibles can lower your premiums

Coverage limits: lowering your coverage limits can reduce your rates

Payment plans: opting for annual payments instead of monthly ones can save you mon

Comparing rates from different providers saves money.

Higher deductibles reduce SR22 insurance premiums.

Annual payments are often cheaper than monthly.

Discounts are available for safe driving courses.

Lowering coverage limits can decrease insurance rate

Understand SR22 insurance requirements in Tennessee.

Find authorized insurers and compare costs.

File SR22 forms with the DMV.

Complete reinstatement process and documentation.

Meet financial obligations and timeline

You'll need to identify authorized carriers that offer SR22 insurance in Tennessee, which can be done by checking the state's department of insurance website or contacting local agents. When searching for authorized carriers, you're looking for companies that are licensed to operate in Tennessee and have the necessary certifications to provide SR22 insurance. You can also reach out to local agents who represent these authorized carriers, as they can guide you through the process of obtaining SR22 insurance that meets Tennessee's requirement

You're required to file an SR22 form with the Tennessee Department of Safety if you've had your license suspended or revoked due to certain traffic violations - personal automobile liability insurance policy. This form serves as proof that you have the minimum liability insurance required by the state. When you file for SR22, you're fundamentally certifying that you have the necessary insurance coverage to operate a vehicle safe

Typically, the reinstatement process in Tennessee involves several steps that must be completed in a specific order. You'll need to fulfill the requirements of your suspension or revocation, which may include paying fines or completing a driver's education course (SR22 insurance cost in TN). Once you've met these requirements, you can begin the reinstatement proce

You'll want to assess these factors carefully to find the best option for your needs. By implementing these budget friendly strategies, you can reduce your SR22 insurance rates and allocate your funds more efficiently. Effective financial planning. personal automobile liability insurance policy is key to managing your insurance costs and ensuring your safety on the ro

You're maneuvering Tennessee's SR22 insurance process after a driving offense, so you'll need to understand the state's requirements. You must maintain coverage for at least three years and face penalties for non-compliance - SR22 insurance cost in TN. You'll research authorized insurers, evaluate costs, and file the SR22 form with the state. Your next steps will involve managing financial obligations and completing the reinstatement process. As you move forward, you'll encounter specific guidelines and deadlines that you'll need to follow to get back on the road, and understanding these details is essential to successfully completing the proce